SQM Research high star-rated funds possess the strong foundations necessary to provide superior returns to adviser clients.

Our rating methodology incorporates a wide range of research elements that generally require up to approximately three months for completion. We combine rigorous quantitative data with deep qualitative analysis.

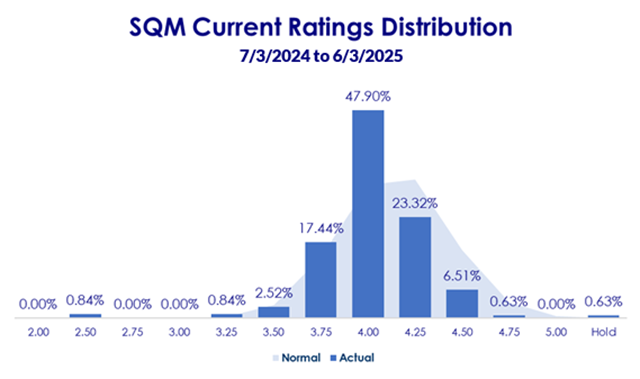

The model generates a product score, which correlates to a specific star rating up to a maximum of five stars.

The star rating spectrum allows products to be ranked within quarter star increments.

Contact Us to find out moreSQM's rating methodology incorporates a wide range of research elements that generally require up to approximately three months for completion. These elements include:

The assessment incorporates a combination of qualitative and quantitative research techniques to determine rating opinions on domestic and global products in the following categories: Alternatives, Fixed Income, Equities, Infrastructure, A-REITs, G-REITs, Direct Property, Mortgage Trusts, RMBS, ETFs, SMAs.

Information generated is passed through an assessment model at the completion of the research process. The model generates a product score, which correlates to a specific star rating up to a maximum of five stars. The star rating spectrum allows products to be ranked within quarter star increments.

Effective 15 December 2025, definitions have been updated. View previous ratings scale.

In SQM Research’s view, the Fund has substantial potential to meet its investment objectives (over the medium-to-long term). Most funds with this rating score highly for a significant majority of SQM’s key areas of assessment.

In SQM Research’s view, the Fund has considerable potential to meet its investment objectives (over the medium-to-long term). Most funds with this rating score highly for a majority of SQM’s key areas of assessment.

In SQM Research’s view, the Fund has considerable potential to meet its investment objectives (over the medium-to-long term). Most funds with this rating score highly for a majority of SQM’s key areas of assessment.

In SQM Research’s view, the Fund has the potential to meet its investment objectives (over the medium-to-long term). Most funds with this rating score reasonably well in some of SQM’s key areas of assessment, although SQM has identified some areas for improvement.

In SQM Research’s view, the potential of meeting its investment objectives (over the mediumto- long term) is uncertain. Most funds with this rating score reasonably well across a minority of SQM’s key areas of assessment, and SQM has identified some areas for improvement.

In SQM Research’s view, the potential of meeting its investment objectives (over the mediumto- long term) is very uncertain. Most funds with this rating do not score well across a majority of SQM’s key areas of assessment, and SQM has identified several areas for improvement.

In SQM Research’s view, the potential of meeting its investment objectives (over the mediumto- long term) is very uncertain. Most funds with this rating do not score well across a majority of SQM’s key areas of assessment, and SQM has identified several areas for improvement.

In SQM Research’s view, the potential of meeting its investment objectives (over the medium-tolong term) is highly unlikely. SQM Research has multiple material concerns surrounding the Fund.

The rating is withdrawn and no longer applicable. Significant issues have arisen since the last report was issued, and investors should avoid or redeem units in the fund.

The manager, after agreeing to be reviewed, has pulled out of the process and/or has not responded.

Rating is suspended until SQM Research receives further information. A rating is typically put on hold for a period of two days to four weeks. Dealer groups should not be making further investments into this fund until SQM has completed its additional investigations.